MUELLER INDUSTRIES (MLI)·Q4 2025 Earnings Summary

Mueller Industries Posts Record Annual Results, Stock Drops 12% on Cautious Outlook

February 3, 2026 · by Fintool AI Agent

Mueller Industries (MLI) delivered its highest annual operating and net income in company history, yet shares tumbled 12% as management tempered expectations for 2026. CEO Greg Christopher acknowledged market conditions "worsened compared to 2024" and warned against expecting an "abrupt rebound" while navigating ongoing tariff disruptions.

Did Mueller Industries Beat Earnings?

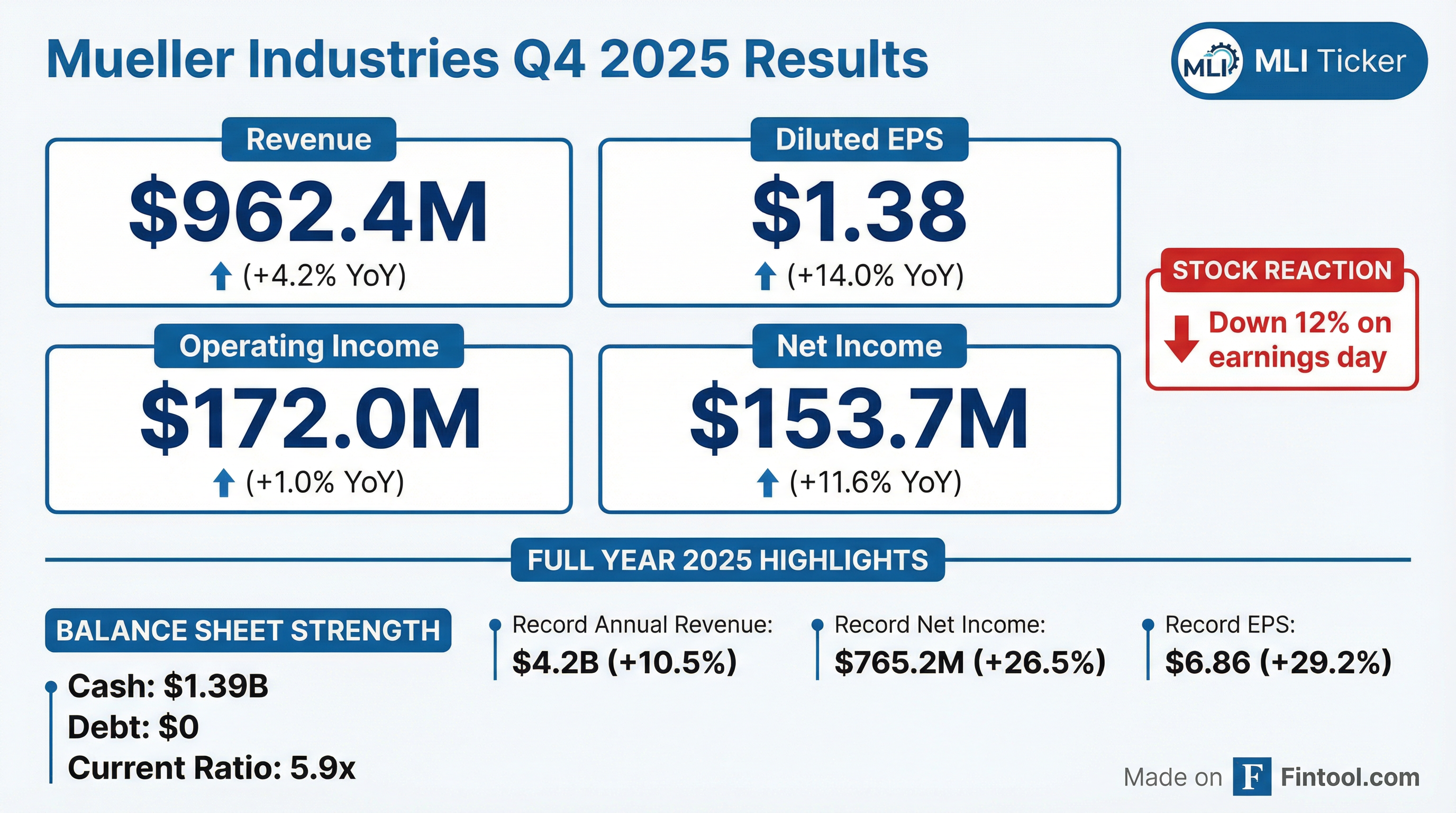

Mueller Industries reported Q4 2025 results that extended its streak of year-over-year quarterly improvements:

Full Year 2025 — Record Results:

Limited analyst coverage for Mueller Industries prevents a clear beat/miss assessment versus consensus expectations.

What Drove the Quarter?

Copper Tailwind, Volume Headwind: COMEX copper averaged $5.13 per pound during Q4, up 22% from the prior year period. Higher copper prices drove increased net selling prices, but unit volumes declined—particularly in core copper and brass products.

Gross Margin Pressure: The quarter included an $18.2 million unrealized loss on open hedge contracts, resulting from a rapid rise in copper prices during the final two weeks of Q4. This compressed gross margin to 25.8%, down from 27.7% in Q4 2024.

Margin Trends (8 Quarters):

*Values retrieved from S&P Global

How Did the Stock React?

Mueller Industries shares fell sharply on the earnings release, dropping approximately 12% to $122.65 from the prior close of $139.18.

The selloff came despite record annual results, reflecting investor concern over:

- Q4 sequential weakness — revenue and margins declined from Q2-Q3 peaks

- Cautious 2026 outlook — no expectation for near-term market recovery

- Tariff uncertainty — ongoing disruption and costs to business operations

- Volume declines — lower unit sales in core products despite higher prices

What Did Management Guide?

Mueller Industries does not provide formal quantitative guidance. However, CEO Greg Christopher offered a measured outlook:

"Although we do not expect market conditions to abruptly rebound in 2026, we nonetheless anticipate considerable improvements as the year progresses."

Key forward-looking comments:

- Several operational improvement initiatives completed in 2025 will deliver financial benefits in 2026

- Company has absorbed tariff and trade policy impacts and will "continue to adapt as such policies evolve"

- Strong balance sheet positions company for strategic acquisitions "when they arise"

How Does This Compare to Prior Quarters?

Q4 2025 represented a step down from the strong Q2-Q3 2025 performance:

*Values retrieved from S&P Global

The Q4 sequential decline reflects typical seasonality in construction-related end markets plus the hedge loss impact on margins.

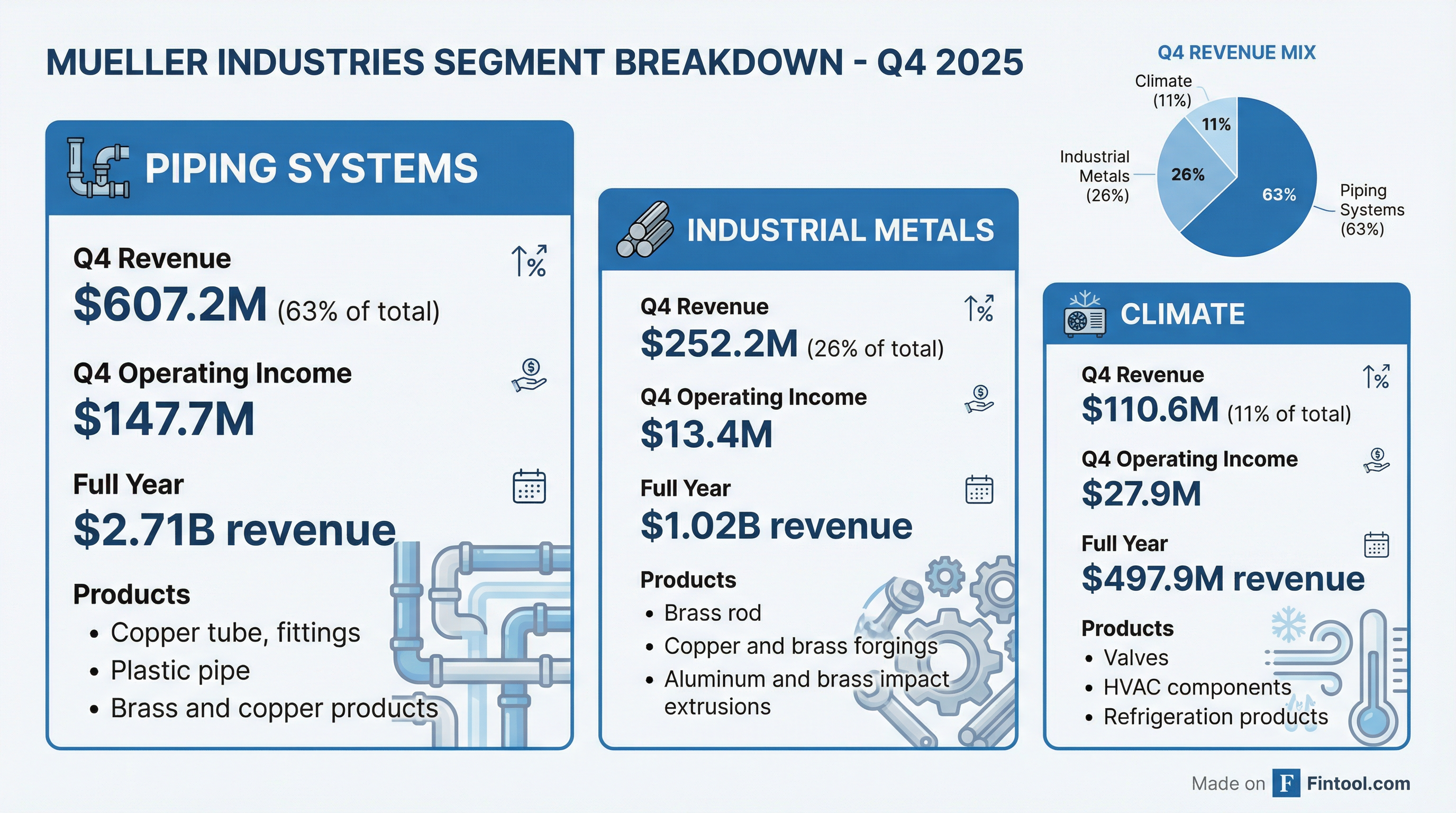

Segment Performance

Q4 2025 by Segment:

Piping Systems drove 63% of revenue and 86% of segment operating income, underscoring Mueller's dependence on copper tube, fittings, and related products.

Balance Sheet Strength

Mueller Industries maintains a fortress balance sheet:

The company generated $141.2 million in operating cash flow during Q4 alone.

Capital Allocation

Mueller Industries prioritized shareholder returns in FY 2025:

- Dividends: $109M paid to shareholders (up from $89M in FY 2024)

- Share Repurchases: $244M repurchased (up from $49M in FY 2024)

- CapEx: $69M invested in property and equipment

The quarterly dividend increased 25% to $0.25 per share from $0.20 in the prior year.

Key Risks and Concerns

-

Commodity Exposure: Copper price volatility directly impacts both revenue and margins. The $18.2M hedge loss in Q4 illustrates this risk.

-

Tariff Uncertainty: Management acknowledged tariffs "imposed disruption and costs" on several businesses and expects policy evolution to continue.

-

Market Conditions: Lower unit volumes in core products suggest underlying demand weakness despite price-driven revenue growth.

-

Concentration Risk: Piping Systems represents 63% of revenue and an even larger share of profits, creating segment concentration.

Looking Ahead

Mueller Industries enters 2026 with record profitability, zero debt, and $1.4B in liquidity—providing ample firepower for strategic moves. However, the market's 12% selloff signals concern that the 2025 earnings peak may be difficult to replicate if:

- Copper prices moderate from elevated levels

- Construction and housing markets remain soft

- Tariff headwinds persist or intensify

Management's commitment to operational improvements and disciplined capital allocation positions the company well, but investors appear to be pricing in a more challenging operating environment ahead.